Charitable Trust Tax Status Calculator

How this tool works

This calculator determines whether your charitable trust qualifies for tax-exempt status and identifies potential tax liabilities based on the type of trust you have and how it operates. Enter your trust details below to see if you're in compliance with IRS rules.

Check results below

When you hear the phrase charitable trust tax, the first thing that comes to mind is whether a trust set up for good can escape the taxman. The answer isn’t a simple yes or no - it hinges on the type of trust, the income it earns, and the rules the Internal Revenue Service (IRS) enforces. Below we break down everything you need to know so you can tell if a charitable trust pays taxes, and what steps keep it in the tax‑exempt lane.

What Exactly Is a Charitable Trust?

Charitable Trust is a legal arrangement where a grantor transfers assets to a trustee for the purpose of supporting charitable causes. It operates under state trust law but must meet federal requirements to enjoy tax‑exempt status. In plain English, the trust’s money goes to public good - education, health, arts, the environment - instead of private individuals.

How the IRS Determines Tax‑Exempt Status

The IRS looks for two things: the trust must be organized exclusively for charitable purposes, and it must not benefit private interests. If it passes, the trust can apply for recognition as a 501(c)(3) organization. Once approved, the trust enjoys exemption from federal income tax on most of its income.

Getting 501(c)(3) status isn’t automatic. The trust must file Form 1023 (or the streamlined Form 1023‑EZ) and include a trust instrument that meets the charitable purpose test. The IRS also checks that the trust has a valid charitable purpose clause, a dedicated trustee, and a clear distribution plan.

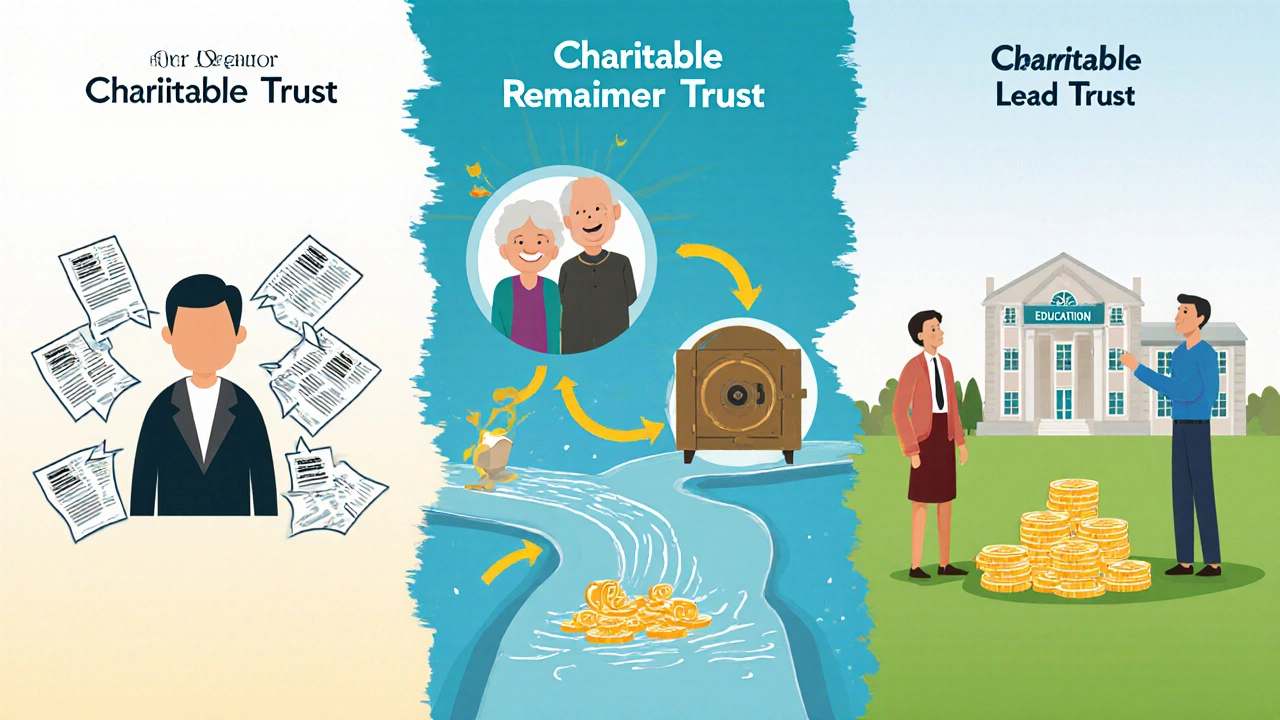

Different Types of Charitable Trusts and Their Tax Implications

- Grantor Trust: The donor retains enough control that the income is taxed to the donor, not the trust. The trust itself is not a separate tax entity.

- Non‑grantor charitable trusts (most public charities) file as separate tax‑exempt entities and are not taxed on qualified income.

- Charitable Remainder Trust (CRT): Generates income for beneficiaries for a set term; the trust pays tax on any unrelated business income (UBI) but the remainder goes tax‑free to charity.

- Charitable Lead Trust (CLT): Pays income to a charity first, then passes the remaining assets to heirs. The trust’s income is taxed similarly to a CRT.

The key takeaway: the trust’s tax treatment depends on who bears the income - the donor, the beneficiaries, or the trust itself.

When Does a Charitable Trust Actually Pay Taxes?

Even a tax‑exempt trust can face tax liabilities in three main situations:

- Unrelated Business Income Tax (UBIT): If the trust runs a trade or business unrelated to its charitable purpose, that income is subject to the corporate tax rate (21%). Typical examples include a café run by a library trust or a parking lot that charges fees without a charitable link.

- Investment Income Thresholds: While most interest, dividends, and capital gains are tax‑exempt, certain types of income (like short‑term gains) may be treated as UBI if they arise from a regularly carried on trade.

- State and Local Taxes: Some states impose franchise taxes or require annual filing fees, regardless of federal exemption.

For a grantor trust, the donor reports all income on their personal return, effectively bypassing the trust’s tax filing.

Distribution Rules and Their Tax Impact

Charitable trusts must distribute their earnings according to the trust instrument. If a CRT pays out a fixed percentage to beneficiaries, that distribution is taxable to the beneficiaries as ordinary income. The trust itself deducts the distribution as an expense, reducing its taxable income (if any).

When a CLT pays the charity first, the charity receives the income tax‑free, but the remaining principal that eventually goes to heirs may be subject to estate tax. Estate Tax applies if the combined value of the trust and other assets exceeds the federal exemption amount (currently $12.92 million for 2025).

State Tax Considerations

Each state has its own rules. For instance, California requires charitable trusts to file Form 109, while Texas only asks for an annual report if the trust holds real estate. Some states levy a minimum franchise tax - often a few hundred dollars - even for tax‑exempt entities.

Because state compliance varies, many trusts hire a local CPA to keep the filings on track and avoid penalties.

Charitable Trust vs. Private Foundation: A Quick Comparison

| Feature | Charitable Trust | Private Foundation |

|---|---|---|

| IRS Classification | Often qualifies as a 501(c)(3) public charity | Classified as a 501(c)(3) private foundation |

| Public Support Requirement | Must receive a broad base of public donations | Generally funded by a single family or corporation |

| Annual Distribution | Must pay out at least 5% of assets (if a public charity) | Must distribute at least 5% of assets each year |

| UBI Exposure | Subject to UBIT on unrelated business activities | Same UBIT rules apply |

| Excise Tax | None for public charities | 2% excise tax on net investment income |

Understanding these differences helps you decide which structure matches your charitable goals and tax planning needs.

Common Pitfalls and How to Stay Compliant

- Mixing Business with Charity: Running a for‑profit venture without proper separation can trigger UBIT and jeopardize exemption.

- Missing the 5% Distribution Rule: Public charities that fall short can lose their status.

- Improper Beneficiary Designation: If a trust’s income ultimately benefits private individuals more than a charitable purpose, the IRS may reclassify it.

- State Filing Neglect: Even if federal exemption is secured, state non‑compliance can result in fines.

Best practice: work with an attorney experienced in nonprofit law and a CPA familiar with charitable trusts. Regular audits and clear record‑keeping make the difference between smooth operation and costly penalties.

Quick Checklist for Tax‑Exempt Charitable Trusts

- Obtain 501(c)(3) recognition from the Internal Revenue Service.

- File Form 990‑EZ or 990 annually, depending on asset size.

- Ensure at least 5% of assets are distributed each year (if required).

- Separate any unrelated business activities and file Form 990‑T for UBIT.

- Register with state charity officials and pay any required franchise fees.

- Maintain detailed records of donations, investments, and distributions.

Bottom Line

In most cases, a properly structured charitable trust does not pay federal income tax on its charitable income. However, any unrelated business activity, certain investment earnings, or state‑level requirements can create tax liabilities. By understanding the trust type, staying on top of filing obligations, and keeping charitable purpose front and center, you can keep the taxman at bay while advancing your philanthropic mission.

Do charitable trusts have to file tax returns?

Yes. Most tax‑exempt charitable trusts must file an annual Form 990 series return with the IRS. Small trusts with assets under $50,000 may qualify for Form 990‑EZ, but the filing requirement remains.

What is Unrelated Business Income Tax (UBIT) and when does it apply?

UBIT is a corporate‑level tax on income generated from a trade or business that is not related to the trust’s charitable purpose. If the trust runs a coffee shop, rents equipment to a for‑profit company, or sells merchandise unrelated to its mission, that income is subject to UBIT at the 21% rate.

Can a grantor charitable trust avoid paying taxes on its income?

In a grantor trust, the donor retains control over the trust’s income, so the donor reports that income on their personal tax return. The trust itself does not file a separate return, effectively shifting the tax burden to the donor.

Do charitable trusts pay state taxes?

State rules vary. Some states require an annual report, a minimum franchise tax, or a state-level exemption filing. Ignoring state requirements can lead to penalties even if the trust is federally exempt.

What happens if a charitable trust fails to meet the 5% distribution rule?

The IRS may revoke the trust’s tax‑exempt status, turning all future income into taxable income. The trust would then owe corporate tax on earnings and could lose donor deductibility benefits.