Family Caregiving Payment Calculator

Calculate your potential hourly wages and monthly income based on state-specific rates for family caregivers.

Note: These are estimates based on state rates for family caregivers. Actual payments may vary based on approval of care hours and specific state program requirements.

If you’re caring for an aging parent, a disabled spouse, or a child with special needs, you’re not alone. Millions of Americans do this every day-often without pay. But here’s the truth: in many cases, the government will pay you to do it. Not as a charity. Not as a bonus. As a legitimate, structured program designed to keep loved ones at home, where they want to be.

How It Actually Works

The federal government doesn’t write you a check directly. Instead, states run programs under Medicaid waivers that let family members get paid to provide care. These are called Consumer-Directed Care programs. They give the person needing care (or their legal representative) control over who provides care and how the money is spent.

Think of it like this: instead of hiring a stranger from an agency, you hire your daughter, your brother, or your sister. And the state pays them the same hourly rate it would pay a professional caregiver.

These programs exist in all 50 states and Washington, D.C. But the rules? They’re different everywhere. In some places, you can get $15 an hour. In others, it’s $25. Some states pay for 20 hours a week. Others pay for 40. It all depends on your state’s budget, the level of care needed, and whether the person qualifies for Medicaid.

Who Qualifies?

To get paid as a family caregiver, three things must be true:

- The person you’re caring for must be on Medicaid.

- They must need help with daily tasks like bathing, dressing, eating, or managing medications.

- You must be approved as a caregiver by the state’s Medicaid agency.

Important: You usually can’t be paid if you’re the spouse of the person you’re caring for. That rule exists in most states. But you can be paid if you’re a child, sibling, parent, or even a close friend who’s not legally responsible for them.

There are exceptions. In states like California and New York, spouses can be paid under certain conditions-usually if the person is younger than 65 and has a disability. Always check your state’s rules.

How to Start

Getting paid doesn’t happen overnight. Here’s the real step-by-step:

- Check if your loved one qualifies for Medicaid. If they’re over 65, have low income, and need help with daily living, they likely do. Apply through your state’s Medicaid office. You can start at medicaid.gov.

- Ask about home and community-based services (HCBS) waivers. These are the programs that allow family caregivers to get paid. Not every Medicaid recipient qualifies for them-only those with high care needs. But if they’re in a nursing home or at risk of going to one, they’re a good candidate.

- Request a care assessment. A nurse or social worker will visit your home and rate your loved one’s needs. They’ll look at mobility, memory, continence, and ability to do basic tasks. The score determines how many hours of care they’re approved for.

- Choose your caregiver. You can pick yourself, your sibling, or another family member. Some states require you to be 18 or older and pass a background check. You don’t need special training-but you’ll get basic instruction on safety and care techniques.

- Complete the paperwork. You’ll become an employee of the state’s program. That means you’ll need to track hours, submit timesheets, and possibly file taxes. Some states use payroll services to handle this for you.

It can take 2 to 6 months from start to payment. Be patient. Keep records. Follow up every two weeks.

What You’ll Get Paid

Hourly rates vary widely:

| State | Hourly Rate | Max Hours/Week |

|---|---|---|

| California | $20-$27 | 40 |

| Florida | $13-$18 | 35 |

| New York | $22-$28 | 40 |

| Texas | $12-$16 | 30 |

| Ohio | $15-$20 | 35 |

| Washington | $21-$26 | 40 |

These are not salaries. They’re hourly wages for actual hours worked. If you’re on the clock for 30 hours a week, you’re earning $450 to $780 a month, depending on your state. That’s not rich-but it covers gas, groceries, and sometimes helps you take time off without guilt.

What You Can’t Do

There are limits. You can’t:

- Pay yourself for cooking dinner if the person can feed themselves.

- Use the money to pay your rent or mortgage.

- Work more than the approved hours-even if you’re doing extra.

- Get paid if you’re the spouse (in most states).

- Get paid if the person isn’t on Medicaid.

Some people try to fake hours or lie about care provided. Don’t. These programs have audits. If you’re caught, you’ll have to pay back every dollar-and you might be banned from the program for years.

Alternatives If Medicaid Doesn’t Work

Not everyone qualifies for Medicaid. Maybe your parent has too much in savings. Maybe they’re under 65 and don’t have a disability. Here are other options:

- Veterans Aid and Attendance Benefit - If your loved one is a veteran, they might get up to $2,900 a month to help pay for care. This can go to family caregivers. Apply through the VA.

- State-specific programs - Some states have non-Medicaid programs. For example, Minnesota’s Consumer Directed Community Supports (CDCS) lets people hire family even if they’re not on Medicaid.

- Long-term care insurance - If your parent bought a policy years ago, it may cover family caregivers. Check the policy wording.

- Personal care agreements - You can legally sign a contract with your parent to pay you for care using their own money. This isn’t government-funded, but it’s legal and can help with estate planning. Get a lawyer to draft it.

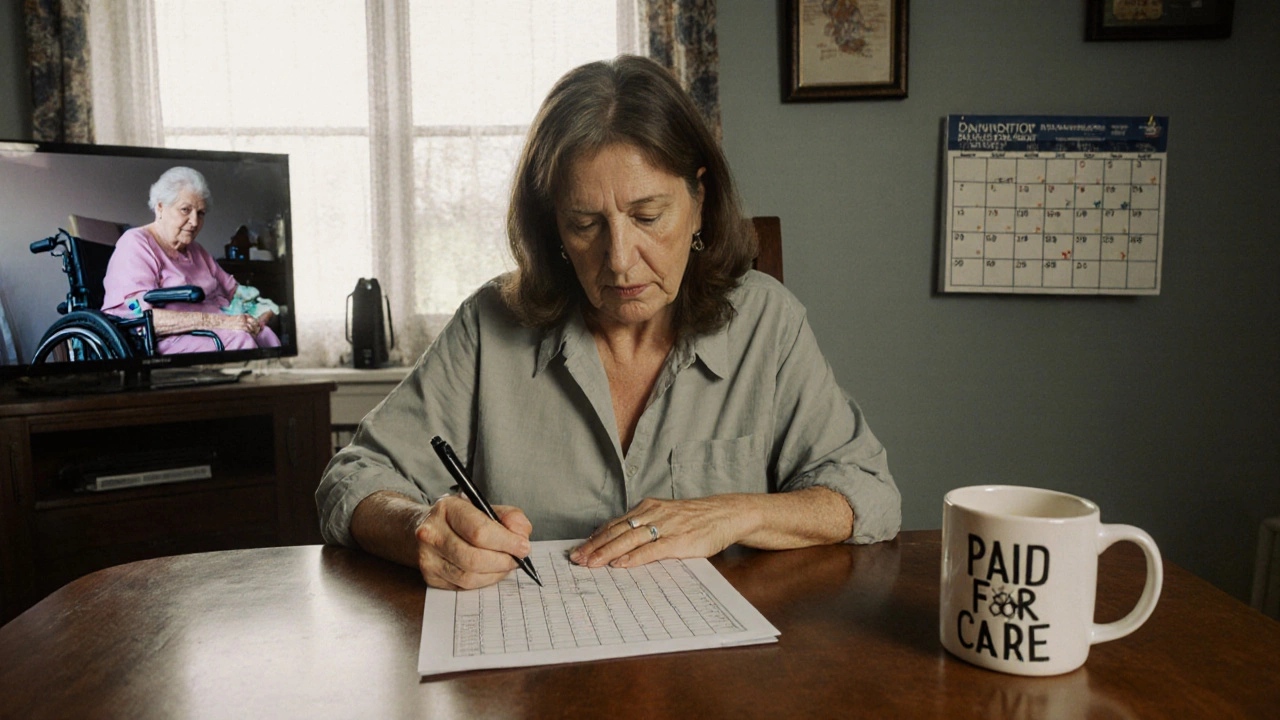

Real Story: What It Looks Like

Janet, 58, from Ohio, cared for her 82-year-old mother with advanced dementia. She quit her job to be there full-time. After six months, she was exhausted and behind on bills. She called the local Area Agency on Aging and asked about Medicaid waivers. They told her she could be paid $18 an hour for 35 hours a week.

She applied. Got approved in 10 weeks. Now she gets a paycheck every two weeks. She uses it to pay for her mother’s medication, her own car repairs, and a part-time home health aide for two days a week so she can rest. She still does the hard work-bathing, feeding, managing meds. But now, she’s not broke.

What to Do Next

Start today. Don’t wait for someone to tell you this exists. Go to your state’s Medicaid website. Search for "home and community-based services waiver" or "consumer-directed care." Call the number. Ask for the family caregiver program.

Bring your parent’s Social Security number, proof of income, and a list of their daily care needs. Be ready to explain what you do every day. You’re not asking for a handout. You’re asking for fair pay for work that keeps someone out of a nursing home.

Thousands of people get paid this way every year. There’s no secret. No trick. Just paperwork and persistence. If you’re doing the work, you deserve to be paid for it.

Can I get paid to care for my spouse?

In most states, no. Medicaid rules typically exclude spouses from being paid caregivers to avoid conflicts of interest. But there are exceptions. States like California, New York, and Washington allow it under certain conditions-usually if the spouse is under 65 and the person receiving care has a disability. Always check with your state’s Medicaid office.

Do I need to be certified to be a paid caregiver?

No, you don’t need a nursing license or certification. But you will need to complete basic training provided by the state program. This usually takes a few hours and covers things like infection control, safe lifting, and recognizing signs of illness. Some states require a background check and fingerprinting.

How much money can I make as a family caregiver?

It depends on your state and how many hours you’re approved for. Most caregivers earn between $12 and $28 per hour, with weekly hours ranging from 20 to 40. That means monthly pay typically falls between $1,000 and $4,500. The money goes directly to you as wages-not as a benefit or grant.

Do I have to pay taxes on this money?

Yes. If you’re paid as an employee, taxes will be withheld automatically. If you’re paid as an independent contractor, you’ll receive a 1099 form and are responsible for paying self-employment taxes. Keep track of your hours and payments. Consult a tax professional if you’re unsure.

Can I get paid if I live in a different state than my parent?

Usually not. Most programs require you and the person you’re caring for to live in the same state-and often in the same household. Some exceptions exist for military families or if the care recipient moves to live with you. Contact your state’s Medicaid office for specifics.

Final Thought

Caring for a family member isn’t just emotional labor. It’s physical labor. It’s mental labor. It’s time you can’t get back. If the government recognizes that nursing homes cost $100,000 a year, why shouldn’t they pay you $20,000 to keep someone at home?

You’re not a burden. You’re a solution. And you deserve to be paid for it.