Charitable Trust Tax Savings Calculator

Calculate Your Tax Savings

Setting up a charitable trust isn’t just about giving back-it’s also one of the smartest ways to reduce your tax bill while supporting causes you care about. Many people assume charitable giving means losing money, but the truth is, the right structure can save you thousands in taxes every year. If you’re thinking about leaving a legacy through a charity, understanding how a charitable trust works-and how it cuts your taxes-is essential.

How a Charitable Trust Lowers Your Income Tax

When you put assets into a charitable trust, you’re not just donating them-you’re transferring ownership to a legal entity designed to benefit a charity. The IRS and HMRC recognize this as a charitable contribution, and that triggers an immediate income tax deduction. The amount you can deduct depends on the type of trust and the value of what you put in.

For example, if you transfer $500,000 in stocks to a charitable remainder trust (CRT), you can claim a deduction based on the present value of what the charity will eventually receive. That’s often between 30% and 50% of the total value, depending on how long the trust pays income to you or your beneficiaries before the charity gets the rest. In 2025, the maximum deduction for cash gifts to public charities is 60% of your adjusted gross income (AGI). For appreciated assets like real estate or stocks, it’s capped at 30% of AGI. Any unused deduction can be carried forward for up to five years.

This means if you’re in the 37% federal tax bracket in the U.S. or the 45% higher rate in the UK, a $150,000 deduction could save you $55,500 or $67,500 in taxes in the first year alone. That’s money you can reinvest or use to fund other goals.

Avoiding Capital Gains Tax on Appreciated Assets

One of the biggest hidden benefits of a charitable trust is escaping capital gains tax. If you sell stocks, property, or other assets that have grown in value, you owe tax on the profit. But if you transfer those assets directly into a charitable trust, you don’t trigger the capital gain. The trust can sell them tax-free and reinvest the full amount.

Let’s say you bought a house in 2010 for $200,000 and it’s now worth $750,000. Selling it would create a $550,000 taxable gain. In the U.S., that could mean up to $137,500 in capital gains tax (20% rate plus 3.8% net investment tax). In the UK, the rate is 20% or 28% depending on your income, so you’d owe between $110,000 and $154,000. But if you put the house into a charitable remainder trust, you avoid that tax entirely. The trust sells the property, reinvests the $750,000, and pays you a fixed income for life-while the charity gets the remainder later. You get the deduction, the charity gets the asset, and the capital gains tax vanishes.

Estate Tax Reduction for Large Estates

If your estate is worth more than $13.61 million in the U.S. (2025 exemption) or £325,000 in the UK (plus the residence nil-rate band), your heirs could owe heavy estate taxes. A charitable trust removes those assets from your taxable estate. That’s a direct reduction in what the government takes after you pass.

For example, a wealthy couple in Scotland with a $10 million estate can reduce their taxable estate by $2 million by funding a charitable lead trust that pays income to a local food bank for 15 years, then transfers the rest to their children. That $2 million drop could save over $800,000 in U.S. estate tax (40% rate) or £800,000 in UK inheritance tax (40% on amounts over the threshold). The charity gets consistent support, your heirs get the remainder, and the tax bill shrinks.

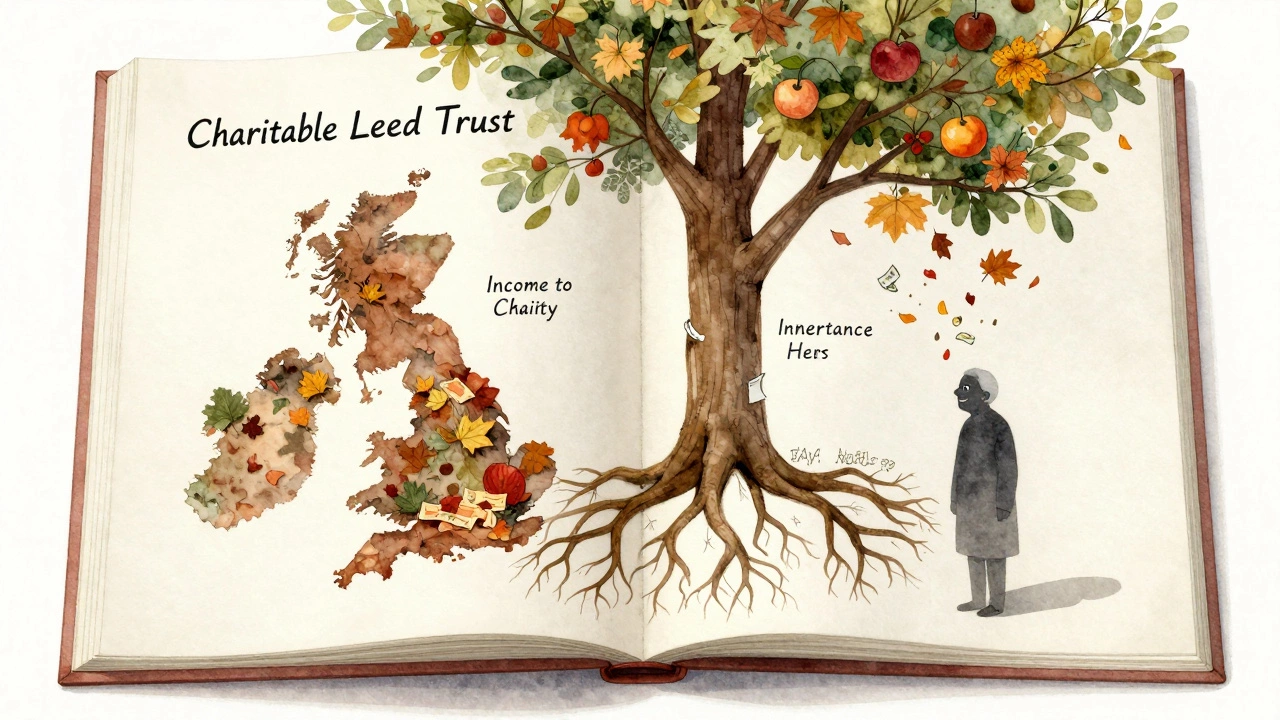

Charitable Remainder Trust vs. Charitable Lead Trust

There are two main types of charitable trusts, and they work in opposite ways.

- Charitable Remainder Trust (CRT): You or your beneficiaries get income for life or a set term. After that, the rest goes to charity. Best if you want income now and a future gift.

- Charitable Lead Trust (CLT): The charity gets income for a set period. After that, the rest goes to your heirs. Best if you want to pass wealth to family with reduced estate taxes.

Both offer tax deductions, but the timing and beneficiaries differ. A CRT is more common among retirees looking for steady income. A CLT is often used by parents wanting to transfer assets to children while minimizing inheritance tax.

What Assets Work Best in a Charitable Trust?

Not everything you own is ideal for a charitable trust. The best assets are those that have grown in value and would trigger high taxes if sold:

- Appreciated stocks or mutual funds

- Real estate (investment properties, vacation homes)

- Private business interests (shares in an LLC or S-corp)

- Art, collectibles, or other high-value personal property

Cash works too, but you don’t get the capital gains benefit. If you’re donating cash, a simple donation to the charity might be simpler. But if you’re holding assets that have doubled or tripled in value, a trust is the smarter move.

What You Need to Know Before Setting One Up

Charitable trusts aren’t DIY projects. They require legal setup, ongoing administration, and compliance with tax rules. Here’s what you need to plan for:

- Minimum funding: Most trusts need at least $100,000 to make sense after legal and administrative costs.

- Trustee: You can’t be the sole trustee. You need a bank, trust company, or trusted individual to manage it.

- Charity selection: The charity must be IRS-recognized (U.S.) or registered with the Charity Commission (UK). Don’t assume every nonprofit qualifies.

- Costs: Expect $5,000-$15,000 in legal fees to set it up. Ongoing fees for trustee services are typically 1% of assets per year.

It’s not cheap, but for people with significant assets, the tax savings often pay for the setup in the first year.

Who Benefits Most From a Charitable Trust?

These trusts are not for everyone. They make the most sense if:

- You have $500,000 or more in appreciated assets

- You’re in the top 20% of income earners

- You want to support a charity long-term

- You’re looking to reduce estate taxes for your heirs

- You’re okay with giving up control of the asset (but still want income)

If you’re giving $10,000 a year from your salary, a simple donation or donor-advised fund is simpler and cheaper. But if you’re sitting on $1 million in stock, a charitable trust turns your gift into a tax-smart engine.

Real-World Example: A Retired Teacher in Edinburgh

Margaret, 72, retired from teaching and owns a flat in Edinburgh she bought in 1998 for £120,000. It’s now worth £580,000. She wants to support the Edinburgh Food Bank but also needs steady income. She sets up a charitable remainder trust with £500,000 of the flat’s value. The trust sells the property tax-free, reinvests the money, and pays her 5% annually-£25,000 per year-for life. After she passes, the remaining balance goes to the food bank.

Her tax savings? She claims a deduction of £180,000 in the year she sets up the trust. At her 45% marginal tax rate, that’s £81,000 back in her pocket. She avoids £96,000 in capital gains tax. And her estate is now £500,000 smaller, reducing inheritance tax for her grandchildren. The food bank gets a lasting gift. Everyone wins.

What Happens If the Charity Goes Under?

Most charitable trusts include a backup clause. If the named charity dissolves or loses its status, the trust documents should name a substitute charity. Always work with a lawyer to make sure this is clearly written. You don’t want your gift stuck in legal limbo.

Can You Change Your Mind Later?

Once you fund a charitable trust, you can’t take the assets back. That’s part of what makes it a charitable gift for tax purposes. But you can often change the charity (if the trust allows) or adjust the payout rate within legal limits. Flexibility exists, but not reversal.

Are There Downsides?

Yes. The biggest is complexity. You’ll need an estate attorney, a tax advisor, and a trustee. There are annual reporting requirements. If the trust invests poorly, your income drops. And if you die early, your heirs get less-though that’s the point of the charity getting the remainder.

It’s not for people who need liquidity or who might need the money back. But for those with surplus assets and a desire to leave a legacy, it’s one of the most powerful tools available.

Can I set up a charitable trust with just cash?

Yes, you can. But you won’t get the capital gains tax benefit, which is the biggest advantage of using appreciated assets. Cash donations to a charitable trust still give you an income tax deduction, but the savings are smaller compared to donating stocks or property that have grown in value.

Do I need to be rich to use a charitable trust?

You don’t need to be a millionaire, but it’s usually only worth it if you have at least $500,000 in assets to put in. Legal fees and trustee costs can eat up smaller donations. If you’re giving under $100,000, a donor-advised fund or direct donation is simpler and cheaper.

Can I name multiple charities in one trust?

Yes. Many trusts allow you to name several charities to receive the remainder. You can split the final payout-say, 60% to a local animal shelter and 40% to a youth center. Just make sure the trust document clearly lists them and their legal names.

Is a charitable trust the same as a donor-advised fund?

No. A donor-advised fund (DAF) is simpler-you donate to a fund managed by a nonprofit, get an immediate tax deduction, and recommend grants over time. A charitable trust is a separate legal entity with more control, longer terms, and the ability to avoid capital gains tax on complex assets like real estate. DAFs are better for smaller, flexible giving. Trusts are for larger, strategic giving.

Can I set up a charitable trust in the UK and get tax benefits there?

Yes. The UK allows charitable trusts and offers income tax relief and inheritance tax exemptions. If you’re a UK taxpayer, you can claim Gift Aid on income payments from a charitable remainder trust, and the assets in the trust are excluded from your estate for inheritance tax purposes. Always work with a UK-qualified solicitor familiar with charity law.