CRT Sustainability Calculator

How Long Will Your CRT Last?

Calculate the estimated lifespan of your charitable remainder trust based on your funding, payout rate, and expected investment return.

Enter values and click Calculate to see how long your trust might last.

Important note: This calculator shows estimated years until trust depletion. Actual results may vary due to market fluctuations and other factors. A 4-5% payout rate with realistic returns offers the best chance of trust sustainability.

If a charitable remainder trust (CRT) runs out of money, the income stream to the donor or other beneficiaries stops. The charity gets whatever is left - but if there’s nothing left, the charity gets nothing. This isn’t a hypothetical scenario. It happens more often than people realize, especially when markets drop, investments underperform, or the trust was set up with unrealistic expectations.

How a Charitable Remainder Trust Is Supposed to Work

A charitable remainder trust is designed to pay income to one or more people - usually the person who set it up - for life or a set number of years. After that, the remaining assets go to a charity. It’s a win-win: you get income now, you get a tax deduction, and the charity gets a gift later.

But that structure only works if the trust has enough money to last. Most CRTs are funded with stocks, real estate, or cash. The trustee invests that money to generate income - dividends, interest, or rent. The payout is usually a fixed percentage, like 5% or 6%, of the trust’s value each year.

Here’s the catch: if the trust’s investments lose value, the payout amount doesn’t shrink. The trustee still has to pay out the same percentage of the reduced balance. So if the trust drops from $1 million to $400,000, and the payout rate is 5%, it still pays $20,000 a year - even though the principal is now only $400,000. That means you’re eating into the principal just to keep the payments going.

What Happens When the Money Runs Out?

When the trust’s assets fall below zero - yes, that can happen - the payments stop immediately. There’s no legal requirement for the trustee to cover the shortfall. The donor or income beneficiary doesn’t get a refund. The charity doesn’t get anything. And the trustee isn’t personally liable unless they made a clear mistake, like investing in something wildly risky or ignoring their fiduciary duty.

This isn’t just a legal technicality. It’s a financial reality. In 2008, during the financial crisis, dozens of CRTs collapsed because their holdings in real estate and stocks plummeted. One case in California involved a CRT funded with a commercial building. When the market crashed, the building lost 70% of its value. The trust kept paying out 6% annually - even though the building was underwater on its mortgage. Within five years, the trust was empty. The donor had already passed away. The charity got nothing.

Why CRTs Fail: Common Mistakes

Most CRTs that fail do so because of poor planning, not bad luck. Here are the top three reasons:

- Overestimating investment returns: Many people assume their trust will earn 7-8% a year. But after fees, taxes, and inflation, a realistic return is closer to 4-5%. If you set a 6% payout rate, you’re guaranteed to drain the trust over time.

- Using illiquid assets: Funding a CRT with private business equity, farmland, or collectibles sounds smart - until you need to sell them to generate cash. These assets take time to sell and often sell at a discount in a down market.

- Ignoring taxes and fees: Trusts pay income tax on capital gains, and trustees charge fees. These costs eat into returns. One study from the National Association of Charitable Gift Planners found that 40% of CRTs underperformed because their fees weren’t accounted for in the payout calculations.

Who Gets Hurt When a CRT Fails?

The biggest loser is usually the charity. These organizations plan their budgets around expected future gifts. A CRT that dies early can leave a nonprofit scrambling to cover programs they thought were funded.

The donor or income beneficiary also loses. If you set up a CRT to pay you $30,000 a year for life, and it runs out after 12 years, you’re suddenly out of income - and you can’t go back and ask for more. You’ve already given up control of the assets. There’s no turning back.

Even the trustee can be at risk. If they didn’t properly diversify the portfolio or failed to monitor the trust’s performance, they could face legal action from beneficiaries - even if the trust was set up correctly.

How to Avoid a CRT Collapse

You don’t have to risk your trust failing. Here’s how to protect it:

- Set a realistic payout rate: Stick to 4-5%. A 5% payout with a 4% return means the trust grows slowly over time. A 7% payout with a 4% return guarantees depletion.

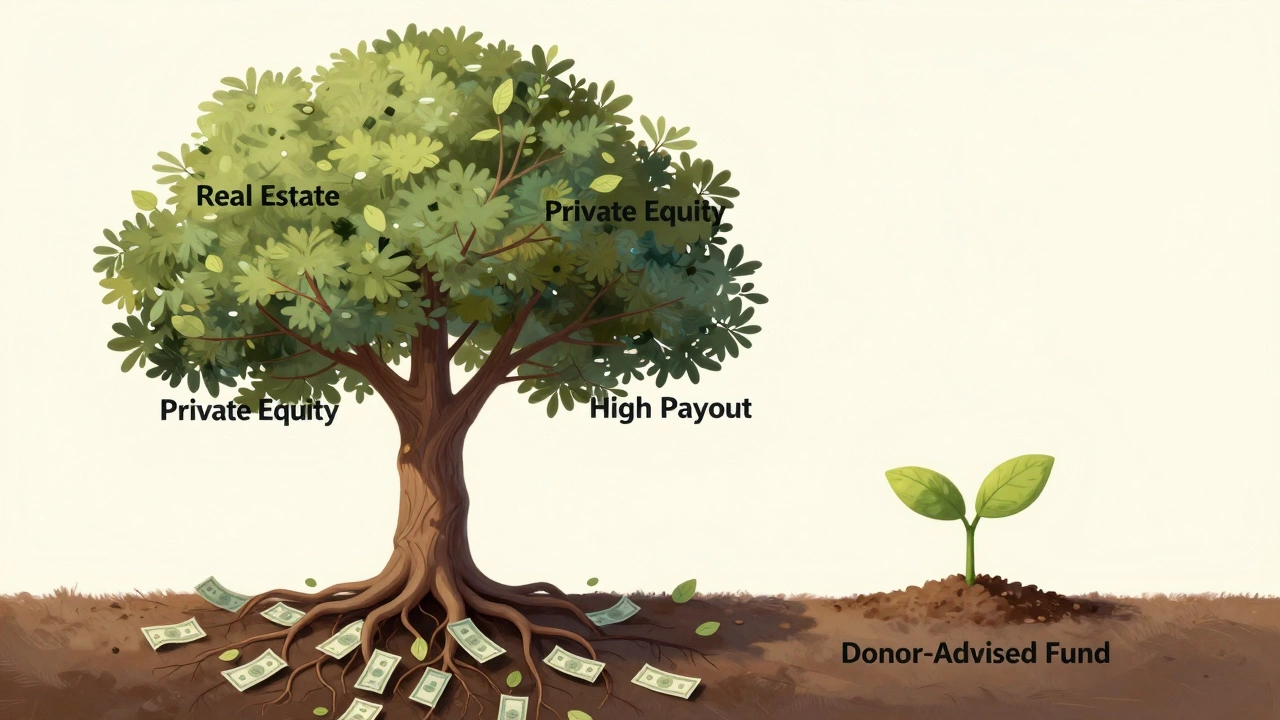

- Use diversified, liquid assets: Stocks, bonds, and mutual funds are better than real estate or private equity. They can be sold quickly if cash is needed.

- Review the trust annually: The trustee should check the portfolio’s performance and adjust if needed. If the trust’s value drops 20% or more, consider lowering the payout temporarily - or even converting to a unitrust with a fixed dollar amount.

- Include a reserve fund: Some trusts set aside 10-15% of the initial assets as a buffer. That money can’t be paid out until the main fund is depleted - and only then, to keep payments going.

- Choose a professional trustee: Banks, trust companies, or experienced attorneys know how to manage these trusts. Family members often don’t have the expertise or time.

What If the Trust Is Already in Trouble?

If your CRT is losing value and you’re worried it won’t last, you have a few options - but they’re not easy.

- Modify the trust: Some states allow trust modifications if all parties agree - the donor (if alive), the beneficiaries, and the charity. You might be able to lower the payout rate or change the investments.

- Transfer assets: If you still own other assets, you might be able to add them to the trust to boost its value. But this requires legal approval and can trigger tax consequences.

- End the trust early: You can petition a court to terminate the trust and distribute what’s left. The charity gets its share, and the remainder goes to the income beneficiaries. But courts rarely approve this unless the trust is clearly unsustainable.

None of these options are quick or cheap. Legal fees can run $10,000 or more. And if the charity refuses to agree, you’re stuck.

Alternatives to a Charitable Remainder Trust

If you’re worried about the risks of a CRT, consider other ways to support charity while still getting income and tax benefits:

- Donor-advised funds: You contribute cash or assets, get an immediate tax deduction, and recommend grants to charities over time. No risk of running out. No complex trust setup.

- Charitable gift annuities: You give money to a charity and they pay you fixed income for life. The charity assumes the investment risk. If they go bankrupt (rare), you might lose payments - but most are backed by state insurance programs.

- Outright gifts with retained life estate: Donate your home or farm but keep living in it. You get a tax deduction, and the charity gets it when you pass. No income stream, but no risk of depletion.

These alternatives don’t offer the same level of control or flexibility as a CRT - but they’re far more reliable.

Final Reality Check

A charitable remainder trust isn’t a magic money machine. It’s a financial tool - and like any tool, it can break if used wrong. Too many people see the tax deduction and the promise of charity and don’t look at the fine print. The trust doesn’t create money. It just moves it around. If the investments don’t perform, the payments stop. The charity gets nothing. And you’re left with nothing but regret.

If you’re thinking about setting up a CRT, talk to a financial advisor who’s handled at least 20 of them. Ask them for real examples of trusts that failed. Ask how they’d protect your trust from market crashes. Don’t trust a sales pitch. Trust the data.

Can a charitable remainder trust go negative?

Yes. If the trust’s investments lose value and the annual payout exceeds the income generated, the trust can deplete its principal. Once the assets hit zero, the trust is empty. There’s no legal mechanism to restore it. The trustee stops payments, and the charity receives nothing.

Does the charity get anything if the trust runs out of money?

No. A charitable remainder trust only gives money to the charity if there’s money left after all income payments are made. If the trust is exhausted, the charity gets nothing. That’s why charities often require donors to provide a financial projection before accepting a CRT.

Can the donor be held responsible if the trust fails?

Generally, no. The donor gives up control when they fund the trust. Responsibility falls to the trustee. However, if the donor misled the trustee about the value of assets or pressured them to make risky investments, they could face legal consequences.

Is there insurance for charitable remainder trusts?

No. There is no insurance product that protects a CRT from investment losses. Some trustees carry errors and omissions insurance, but that only covers mistakes in management - not market downturns.

What’s the safest way to fund a charitable remainder trust?

The safest assets are publicly traded stocks, bonds, or mutual funds with low fees and steady dividends. Avoid real estate, private company shares, or collectibles. A diversified portfolio with a 4-5% payout rate and annual reviews gives the best chance of long-term survival.