Charitable Trust Tax Impact Calculator

How Your Donation Makes a Difference

Charitable trusts in Scotland offer significant tax benefits that maximize your giving impact. Enter your donation amount to see exactly how much more you can help through tax advantages.

Your Tax Savings & Impact

Your £ donation could fund community services through tax benefits.

Based on UK charitable trust tax rules. Actual savings may vary based on individual circumstances.

When people think of charities, they often picture donation bins, bake sales, or fundraising runs. But behind many of the biggest nonprofits in Scotland-and around the world-is something quieter, more powerful, and often misunderstood: the charitable trust. So what exactly is the purpose of a charitable trust? It’s not just a bank account for donations. It’s a legal structure designed to protect money, ensure long-term impact, and keep a charity’s mission alive, even after the founders are gone.

It’s About Permanence, Not Just Giving

Most people give to charity because they want to help right now. A charitable trust is different. It’s built to last. Think of it like planting an oak tree instead of lighting a candle. The money doesn’t just get spent-it’s invested. The interest, dividends, and returns from those investments fund the charity’s work forever. In Scotland, trusts like the Charitable Trust for Scottish Heritage a legally registered trust that preserves historic buildings and funds educational programs in rural communities have been supporting local projects for over 70 years, thanks to careful management of their endowment.This permanence matters because social needs don’t disappear after a good news cycle. Homelessness, mental health services, and rural education don’t pause because the headlines moved on. A charitable trust ensures the work continues, year after year, no matter what’s happening in the economy or politics.

It Protects the Donor’s Intent

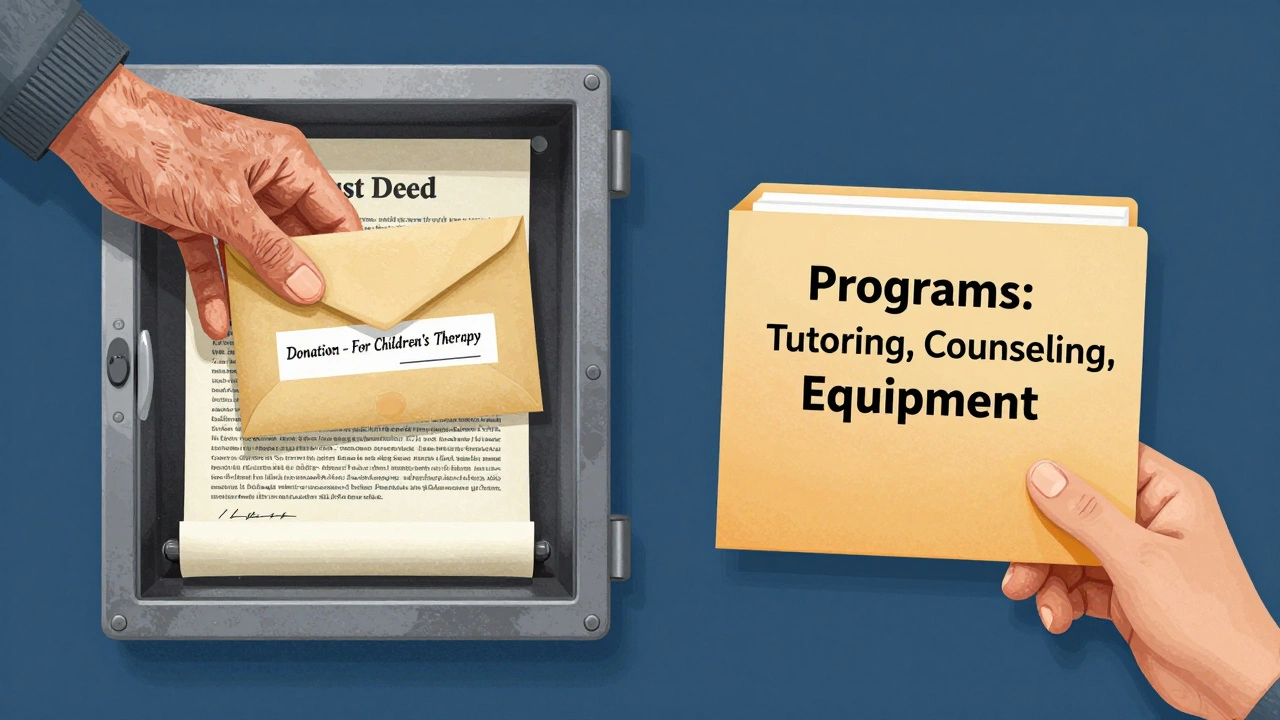

Imagine someone donates £500,000 to help children in Edinburgh with learning disabilities. They want that money used only for tutoring, therapy, and specialized equipment-not for office rent or staff salaries. Without a trust, that money could end up being redirected by future trustees or board members who have different priorities.A charitable trust locks in the donor’s original purpose. The trust deed-a legal document created when the trust is set up-says exactly what the money is for. It can’t be changed easily. Even if the charity grows, or the board changes, the trust’s purpose stays fixed. This is why so many families in Scotland choose to set up trusts in memory of loved ones. It’s not just a gift. It’s a promise kept.

It Offers Tax Benefits That Help Everyone

In the UK, charitable trusts enjoy significant tax advantages. Donations to registered trusts are exempt from income tax, capital gains tax, and inheritance tax. That means more money stays in the system to do good work. If someone leaves £1 million to a charitable trust in their will, the estate doesn’t pay inheritance tax on it. That’s £300,000 or more saved-money that goes straight into programs instead of to the government.These tax rules aren’t just for the wealthy. Even modest donations benefit. If you give £100 a year to a registered trust, the government adds 25% through Gift Aid. That’s £125 for every £100 you give. And because the trust holds the money long-term, those small gifts compound over decades.

It Separates Management from Operations

Many charities struggle because the same people who run the day-to-day work are also in charge of the money. That can lead to conflicts, poor decisions, or even misuse of funds. A charitable trust fixes that by splitting responsibilities.Typically, the trust holds the assets-cash, property, investments. A separate board of trustees manages those assets. A different team runs the charity’s programs: the outreach workers, teachers, counselors. This separation keeps the money safe and the mission clear. In Scotland, organizations like The Highland Food Trust a charitable trust that owns and manages food distribution hubs across the Highlands, ensuring meals reach remote villages use this model to make sure every pound goes to feeding people, not to administrative bloat.

It Allows for Strategic Giving

A charitable trust isn’t just about handing out cash. It’s about making smart, long-term decisions. Trustees can invest in property, bonds, or ethical funds. They can wait for the right moment to give-like funding a new community center when land becomes available, or backing a pilot program that could scale up later.This flexibility is why trusts often outperform regular charities in long-term impact. A charity that relies on annual donations might have to cut services in a recession. A trust with a £2 million endowment can keep paying staff and running programs, even when donations dip. In 2023, when inflation hit hard, trusts in Scotland with diversified portfolios saw their payouts rise by 4.2%, while cash-reliant charities dropped by 11%.

It Builds Community Trust

People give more when they know their money is safe. A charitable trust, especially one with a transparent governance structure and independent trustees, signals responsibility. Donors aren’t just giving to a name-they’re giving to a system that’s been checked, audited, and legally bound to act in good faith.That’s why community trusts in places like Orkney and Argyll have seen donation rates climb. Locals know their money won’t vanish into vague programs. They know it’s held by people who are legally required to follow the rules. That trust-literally and figuratively-makes people more willing to give.

It’s Not Just for Big Money

You don’t need millions to start a charitable trust. Many small trusts in Scotland begin with £10,000 or even less. A local group might set one up to fund a school garden, a youth music program, or a walking group for seniors. The key is having a clear purpose and a plan to manage the money responsibly.Organizations like The Community Trust Network Scotland a support body that helps small groups establish and manage charitable trusts with low-cost legal templates and training offer free tools to help anyone get started. You don’t need a lawyer to begin-you just need to know what you want to achieve and who will oversee it.

What Happens When the Trustee Dies?

One of the biggest fears people have about trusts is that they’ll die with the founder. But that’s not how they work. A trust is a legal entity, not a person. When a trustee passes away, their role is filled by someone else named in the trust deed-or appointed by the remaining trustees. The money keeps working. The mission keeps going. That’s the whole point.In fact, many of Scotland’s most enduring trusts were started by people who died decades ago. The Dunblane Memorial Trust established after the 1996 school tragedy to fund trauma support for children and families still gives out grants today, guided by a board of local educators and mental health professionals-not the original donors.

How to Know If a Trust Is Legitimate

Not every trust is real. Some are scams pretending to be charities. In Scotland, all charitable trusts must be registered with the Office of the Scottish Charity Regulator (OSCR). You can check a trust’s status for free at their website. Look for:- A registered charity number (starting with SC)

- A clear statement of purpose in the trust deed

- Annual reports showing how money was spent

- Independent trustees, not just family members

If any of those are missing, walk away. Real trusts don’t hide. They publish everything.

Why This Matters for You

Whether you’re thinking of donating, leaving money in your will, or starting a local project, understanding the purpose of a charitable trust changes how you think about giving. It’s not about quick fixes. It’s about legacy. It’s about making sure that when you say, ‘I care about this,’ your words turn into something that lasts.Charitable trusts don’t make headlines. But they’re the quiet force behind most of the good that lasts.

Can a charitable trust make a profit?

Yes, but it can’t keep the profit for itself. A charitable trust can earn money through investments, property rentals, or events. But any profit must be used to support its charitable purpose. It can’t pay dividends to owners or shareholders because there are none. The goal is to grow the fund so it can give more over time.

Can a charitable trust be dissolved?

Only under very strict conditions. If the original purpose becomes impossible or irrelevant, the trust can apply to OSCR to change its purpose or wind down. But it can’t just close and give the money to the trustees. The assets must go to another charity with a similar mission. This ensures the donor’s intent is honored, even if the original goal can’t be met anymore.

Do I need a lawyer to set up a charitable trust?

Not always, but it’s strongly recommended. You can draft a basic trust deed yourself, but if you want it to be legally enforceable and tax-registered, you need to follow strict rules. A solicitor who specializes in charity law can help you avoid mistakes that could invalidate the trust later. Many community trusts in Scotland use free legal clinics offered by organizations like Law Society Scotland.

How is a charitable trust different from a regular charity?

A regular charity is usually run by a board that manages both money and programs. A charitable trust separates those roles: one group holds and invests the money (the trustees), and another group runs the programs (the charity staff). Trusts are often funded by endowments, while regular charities rely more on donations and grants. Trusts are also harder to change, which protects long-term goals.

Can I start a charitable trust for my local dog shelter?

Absolutely. Many small animal welfare groups in Scotland run as charitable trusts. You’d need to define a clear purpose-like ‘providing medical care and rehoming services for stray dogs in West Lothian’-and register with OSCR. Once approved, you can accept donations, apply for grants, and even buy property for a shelter. The trust structure ensures the shelter survives even if volunteers move away or retire.